At Fit 2 Trip we offer you coverage for medical expenses only to protect our travellers. We know that to enjoy a peaceful vacation abroad, especially in some countries, you need travel insurance for emergency medical expenses.

When traveling, especially in countries where medical treatment is not free, having reliable travel insurance gives you the peace of mind you need to enjoy your vacation.

Also, many people are unaware that a large number of insurance companies exclude coverage for pre-existing medical conditions in their policies.

For this reason, contracting travel insurance for medical expenses and coverage for previous medical conditions is always highly recommended, although this is a personal choice.

However, it is important to carefully evaluate all the risks of not taking out insurance with medical coverage, especially depending on your destination.

In some countries, the health system guarantees free medical care, while in others it is always paid by the patient. The best known case is that of the United States, where even the simplest medical tests can involve a very high cost.

However, the United States is not the only destination with high health costs: China, Canada, Japan, Thailand and Turkey also have similarly high health costs and it is not recommended to travel to these countries without travel insurance with medical expenses covered.

In addition, many countries require travelers to carry travel insurance for emergency medical expenses and the possible repatriation of the patient, as a condition for granting an entry visa. Among them, just to mention a few: Cuba, Thailand and Algeria.

From the point of view of insurance, the term health insurance is inappropriate, because there is no guarantee with that name, but rather a set of benefits and reimbursements related to expenses incurred in medical care, which is perhaps one of the most important aspects when away from home.

1) The Emergency Medical Expenses guarantee, in case of illness or accident during the validity period of the travel medical policy, allows you to obtain reimbursement for the medical costs incurred, such as hospitalisation costs.

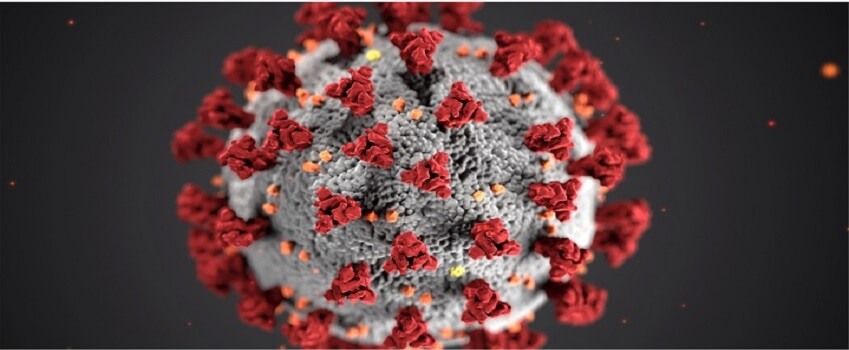

In addition, reimbursements will also be recognised in case of terrorist acts. At Fit 2 Trip all our policies offer coverage if you get COVID-19 during your trip.

2) Medical repatriation. If you become seriously ill during your trip and the country or area you are traveling through has limited medical facilities, you may need specialist assistance to get to the nearest medical facility or even be transported home.

All Fit 2 Trip travel insurance policies for medical expenses include repatriation coverage, which cover you and the people you are traveling with to be transferred to the appropriate medical centers, depending on the required medical need.

3) Repatriation of mortal remains: This service is also covered by our travel insurance policy for medical expenses.

At Fit 2 Trip, our medical travel insurance policies are designed to offer you protection against emergency costs related to your health and repatriation in case of medical necessity during your trip.

Customers can travel knowing that, should a health emergency occur, they will have access to 24-hour medical assistance and a network of hospitals for treatment at their destination and, if medically necessary, repatriation costs are also included.

Travel insurance policies with medical expenses only are available for single trips or for multiple trips during one year in an annual multi-trip policy* where clients can choose Basic, Standard or Premium levels of coverage, whichever suits their needs.

Likewise, at Fit 2 Trip we offer our travellers cancellation insurance for financial protection in case they need to interrupt or cancel their trip.

Choose to travel with peace of mind and safety thanks to Fit 2 Trip's travel insurance with medical expenses for your business trips or to enjoy your vacations to the fullest.

*In annual multi-trip policies, no trip must exceed 31 days.

For full details read our General Conditions.